All Categories

Featured

Table of Contents

There is no payout if the plan runs out prior to your fatality or you live beyond the policy term. You might be able to renew a term plan at expiration, however the premiums will certainly be recalculated based on your age at the time of renewal.

At age 50, the costs would certainly increase to $67 a month. Term Life Insurance coverage Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for men and females in exceptional health.

Universal Life Insurance Vs Term Life Insurance

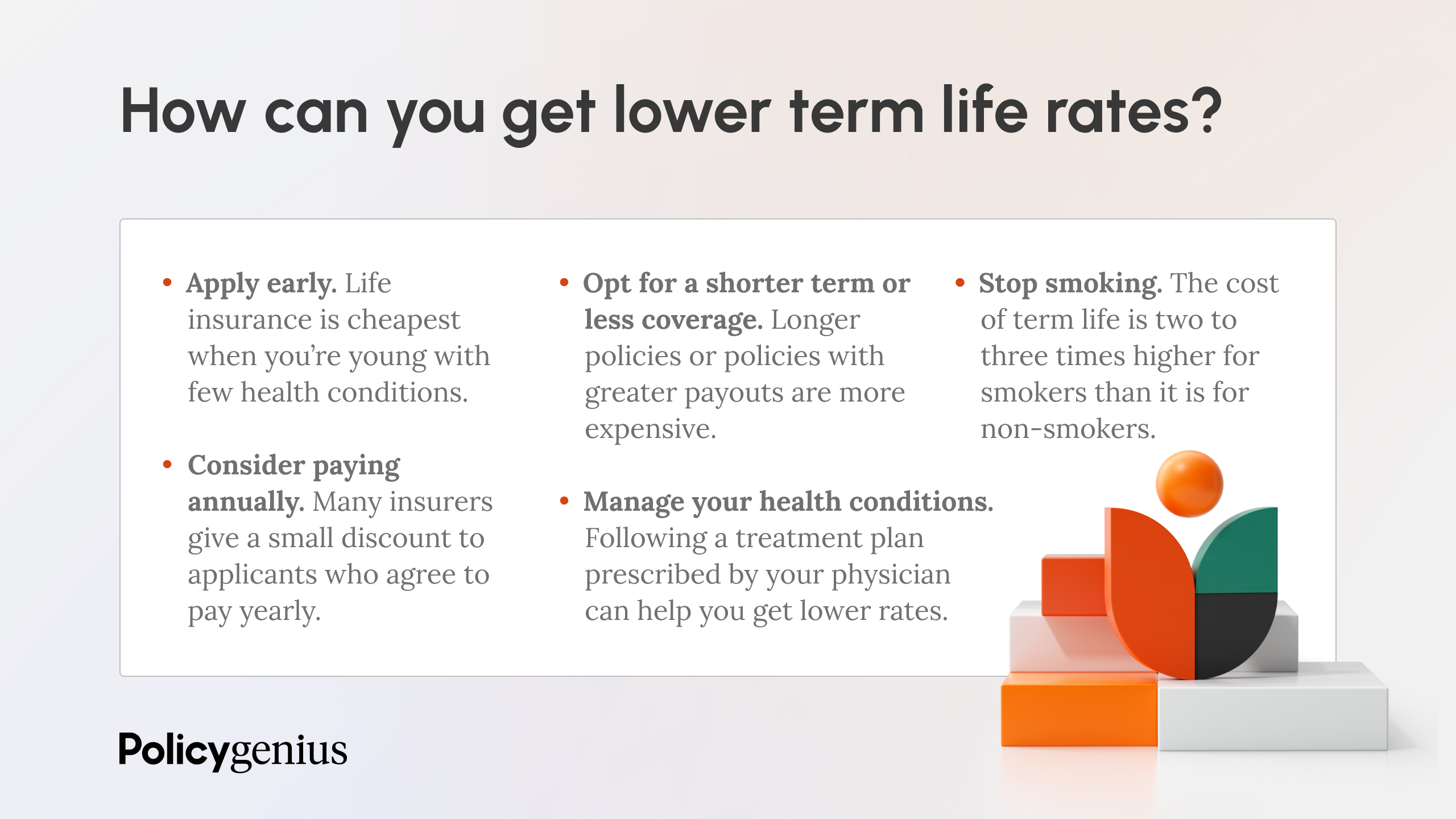

The minimized threat is one element that enables insurance companies to bill reduced costs. Rate of interest rates, the financials of the insurance provider, and state laws can likewise impact premiums. As a whole, firms typically use far better prices at the "breakpoint" protection degrees of $100,000, $250,000, $500,000, and $1,000,000. When you consider the amount of insurance coverage you can obtain for your premium dollars, term life insurance coverage has a tendency to be the least pricey life insurance coverage.

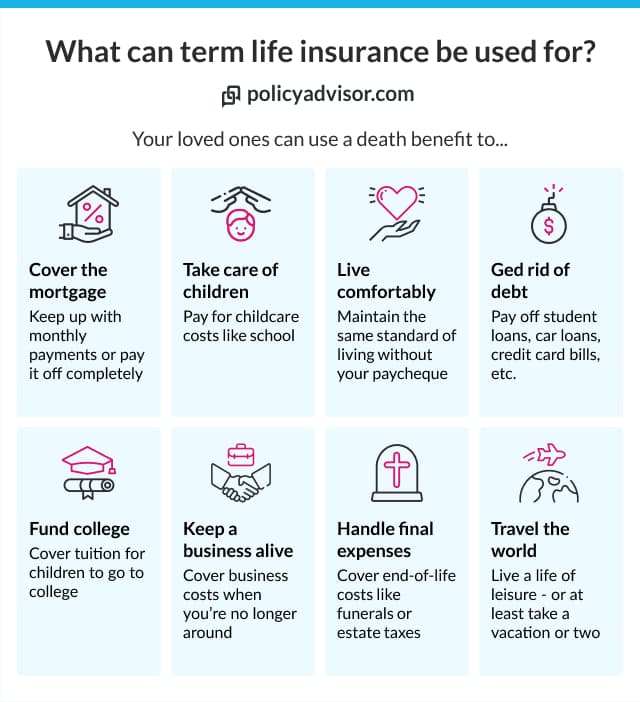

Thirty-year-old George wishes to protect his family members in the not likely occasion of his passing. He acquires a 10-year, $500,000 term life insurance plan with a costs of $50 each month. If George dies within the 10-year term, the plan will pay George's beneficiary $500,000. If he dies after the plan has run out, his beneficiary will certainly obtain no advantage.

If George is identified with an incurable health problem during the very first plan term, he probably will not be eligible to restore the plan when it ends. Some plans use assured re-insurability (without proof of insurability), yet such features come at a higher price. There are a number of sorts of term life insurance policy.

Normally, the majority of firms provide terms ranging from 10 to 30 years, although a couple of offer 35- and 40-year terms. Level-premium insurance coverage (does term life insurance cover cancer) has a set month-to-month payment for the life of the policy. Most term life insurance policy has a level costs, and it's the type we've been describing in the majority of this article.

Which Of The Following Best Describes Term Life Insurance

Term life insurance is appealing to young individuals with kids. Moms and dads can get substantial protection for an inexpensive, and if the insured dies while the policy is in effect, the family members can rely upon the survivor benefit to change lost earnings. These policies are likewise fit for individuals with expanding families.

The right selection for you will certainly depend on your requirements. Right here are some things to think about. Term life plans are optimal for people that desire substantial insurance coverage at an affordable. People that possess entire life insurance policy pay much more in costs for less coverage however have the safety and security of understanding they are shielded permanently.

The conversion biker should allow you to transform to any kind of irreversible plan the insurance coverage business provides without restrictions - renewable term life insurance advantages. The primary features of the cyclist are keeping the original health ranking of the term policy upon conversion (also if you later on have wellness concerns or become uninsurable) and choosing when and just how much of the protection to transform

Of training course, overall costs will certainly enhance significantly since whole life insurance coverage is extra expensive than term life insurance coverage. Clinical conditions that create throughout the term life period can not cause premiums to be increased.

Term life insurance policy is a fairly economical means to supply a lump sum to your dependents if something takes place to you. It can be a great option if you are young and healthy and sustain a family. Entire life insurance policy includes significantly greater month-to-month premiums. It is indicated to offer coverage for as long as you live.

Term Life Insurance For Pilots

Insurance firms set an optimum age limit for term life insurance policy plans. The premium also rises with age, so an individual aged 60 or 70 will pay substantially even more than someone years younger.

Term life is rather similar to cars and truck insurance. It's statistically unlikely that you'll need it, and the premiums are money down the tubes if you don't. However if the most awful happens, your household will get the advantages.

This plan style is for the client that requires life insurance policy however would love to have the capability to choose how their cash worth is spent. Variable plans are underwritten by National Life and distributed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Business, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 award information, check out Permanent life insurance creates cash worth that can be obtained. Plan fundings accrue passion and overdue plan financings and interest will certainly lower the fatality benefit and money value of the plan. The amount of money worth offered will generally rely on the sort of long-term plan purchased, the quantity of coverage purchased, the length of time the plan has actually been in pressure and any exceptional plan finances.

North Carolina Term Life Insurance

A total statement of protection is located just in the plan. Insurance plans and/or associated bikers and attributes may not be offered in all states, and policy terms and conditions might vary by state.

The major distinctions between the different sorts of term life policies on the marketplace concern the length of the term and the protection amount they offer.Level term life insurance coverage features both degree premiums and a degree fatality advantage, which suggests they remain the very same throughout the duration of the policy.

, likewise known as a step-by-step term life insurance strategy, is a policy that comes with a fatality benefit that increases over time. Typical life insurance policy term lengths Term life insurance coverage is budget friendly.

The primary differences in between term life and entire life are: The length of your protection: Term life lasts for a collection period of time and after that expires. Average month-to-month entire life insurance policy rate is determined for non-smokers in a Preferred health category, getting an entire life insurance coverage plan paid up at age 100 provided by Policygenius from MassMutual. Aflac provides numerous lasting life insurance coverage plans, including entire life insurance coverage, final expense insurance policy, and term life insurance coverage.

Latest Posts

Ladderlife Cost For Term Life Insurance

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called An

Term To 100 Life Insurance